We often hear from trustees that they don’t have sufficient information to help their members plan for retirement. Although nothing can replace personalised data about members, the Australian Bureau of Statistics (ABS) provides valuable information about Australians in retirement and insights into the aspirations and intentions of those approaching retirement.

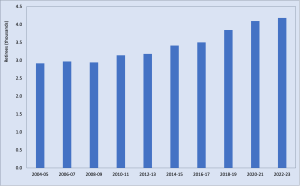

Recently, the ABS unveiled its latest Retirement and Retirement Intentions report, based on surveys conducted in the 2022-23 financial year. The report shows there were 4.2 million retirees in Australia, marking a substantial increase of over 40% in the past nine years. Retirees now make up about 16% of the Australian population, up from 14% over the same period (see Chart 1).

According to the report, over 700,000 Australians will join the ranks of retirees in the next five years and over 200,000 in the next two years.

Chart 1: Number of retirees by year

Source: ABS Retirement and Retirement Intentions, Australia, 2022-23

Sources of funding in retirement

Superannuation fund trustees need to understand the various sources of retirement funding that their members are likely to rely on. Government pensions are an important source for many Australians. Nearly a third of all retirees rely on government pensions as their only source of retirement funding. This reliance is decreasing as the superannuation system matures and more Australians are fully or partly self-funded at retirement (see Chart 2).

Chart 2: Funding status

Source: ABS Retirement and Retirement Intentions, Australia, 2022-23

Superannuation now represents the main source of personal income for 27% of retirees, up from 20% in 2014-15 (see Chart 3).

Chart 3: Main source of personal income in retirement

Source: ABS Retirement and Retirement Intentions, Australia, 2022-23

The report shows some improvement in the position of women retirees. The percentage of women reporting no personal income is down to 18%, down from 37% a decade ago. Many women still relied on their partner’s income as their main source of funds for meeting living costs in retirement. However, this has fallen by more than 10 percentage points over the decade, dropping from 44% in 2012-13 to 31% in 2022-23.

Why and when do Australians retire

On average, Australians plan to retire at 65.4 years. However, superannuation funds should not assume that all members have a clear retirement date in mind. Surprisingly, 38% of those surveyed who intended to retire were unsure about when they would leave the workforce.

When asked about the factors influencing their decision about when to retire, the top three influencing factors were financial security (36%), personal health or physical abilities (22%) and reaching the eligibility age for an age pension (14%), highlighting the diverse considerations shaping retirement plans for Australians.

But, as Mike Tyson told the reporter who asked him whether he was worried about Evander Holyfield and his fight plan: “Everyone has a plan until they get punched in the mouth.”

Of those who retired in the last 20 years, about 25% of these retirements were involuntary. Reasons include:

- lost last job for economic reasons (retrenched)

- own sickness, injury or disability

- to care for an ill, disabled, or elderly person

These results are consistent with findings that TAL Life has recently published from its survey, “What I Wish I Knew About Retirement,” TAL found that while most plan to retire between ages 65 and 69, 59% retire before this age.

“When retirement arrives sooner than expected, it can derail a person’s ability to prepare as much as they’d like to”.

Ashton Jones, GM Growth, Retirement & Wealth Partnerships at TAL

A useful source of information on retirees

Trustees need to leverage various internal and external data sources to build a comprehensive understanding of their members’ retirement needs. The ABS Retirement and Retirement Intentions Report is an invaluable resource, offering deep insights into the landscape of Australian retirees. By incorporating this data, trustees can enhance their strategies and better support their members’ journey towards a fulfilling retirement.

Authors: David Orford & Stephen Huppert