Longevity Risk: The mother of all retirement risks

We all face uncertainty in retirement – from deciding when to leave full-time work, to wondering how long we need to plan for and whether we will have enough funds to last the distance – and everything in between.

The recently introduced Retirement Income Covenant recognised the uncertainty around this time of life and now requires superannuation funds to have a retirement income strategy that clearly sets out how the trustee will assist their members to manage the risks to the sustainability and stability of their retirement income.

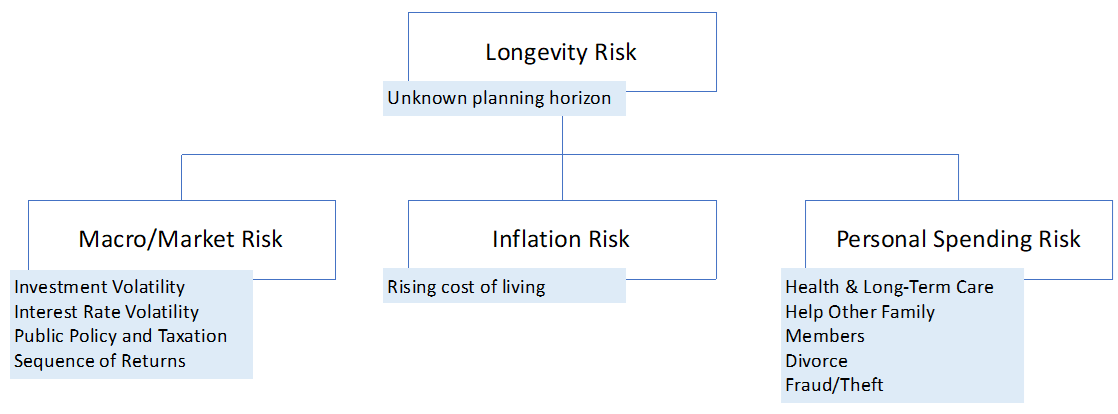

The list of retirement risks seems to be endless: investment risk, sequencing risk, inflation risk, expenditure risk, health risk, and on and on it goes. But it is longevity risk that is the mother of all retirement risks—the longer you live, the more exposed you are to all the other associated retirement risks.

Retirement planning expert, Wade Pfau, illustrates this relationship in his article Retirement Risks: It All Starts With Longevity with the following diagram.

When it comes to Longevity Risk, there are two sides.

The first, and most commonly associated, is the risk of outliving your retirement savings. The second, less often discussed, is the risk of underspending your savings, leading to a lower income over retirement.

The final report of the Retirement Income Review[i] expressed concern that retirees, driven by the fear of running out of money in retirement, appear to be self-insuring against longevity risk and only consuming the minimum necessary to avoid running out of savings. It observed that “longevity risk protection is important as it allows people to confidently draw down assets to fund their retirement”.

David Orford addressed longevity risk in a recent article: Why you will live longer than you think where he wrote, “Getting life expectancy right and understanding how long we will live—and making sure we have enough retirement funds to last the distance—might be one of the most significant risks in retirement”.

Longevity risk: underestimated and underappreciated

So how can superannuation funds better assist their members to manage the risks to the sustainability and stability of retirement income, as required by the Retirement Income Covenant?

Increasing evidence is emerging that we underestimate the impact of longevity risk and underappreciate its place in the retirement risk pantheon. Therefore, a good starting point for superannuation funds is understanding why longevity risk is underestimated and underappreciated.

A 2014 National Seniors Australia survey found that senior Australians underestimated their life expectancy by up to seven years. On average, individuals between 50 and 54 assumed they would live until they were 81.4 when they should expect to reach 88.5 years. Individuals between the age of 65 and 69 were also underestimating their longevity, expecting to live until 84 years when, in fact, they are likely, on average, to survive until they are 88 years old.

A recent survey by YourLifeChoices revealed that retirees’ expectations of how long they might live fall short by quite a few years. For example, on average, respondents expect a 65-year-old male to have a life expectancy of just 82 years. Women aged 65, on the other hand, are expected to live longer and reach an average of 85 years.

This underestimating of life expectancy appears to be a global phenomenon. The Stanford Center on Longevity article Underestimating Years in Retirement has a good summary of research that suggests a prevailing tendency for people to underestimate their longevity and concludes that “resulting financial implications are quite large”.

Research by Alison O’Connell, a policy advisory working in pensions, retirement and longevity, found that New Zealand men underestimated on average by over five years and women by over seven years, compared to realistic expectations of life from tables that allow for current age, gender and future longevity improvements.

Similarly, in the UK, the Institute for Fiscal Studies reported in 2018 that its research found that those in their 50s and 60s tended to underestimate their chances of survival to age 75 by around 20 percentage points and to 85 by around 5–10 percentage points, phrasing the term ‘Survival pessimism’.

Still not convinced? Google “life expectancy Australia” and “life expectancy age 65 Australia“. Given the results (seen below), it is no surprise that these life expectancy values are the ones front of mind when we plan for retirement. More concerning is that these are often the values superannuation funds and financial planners use in their calculators and projection tools when helping members/clients with their retirement planning!

What can a superannuation fund do?

Appreciating that longevity risk is the most important and perhaps the most challenging part of retirement planning for both advisers and clients is a good start.

Members planning for retirement might have an average life expectancy, but as individuals, this is not a particularly useful measure—especially if this average is an unadjusted average from the Australian Life Tables. Learn the lesson of the statistician who drowns while crossing a river that he calculates is, on average, one metre deep. If he were alive to tell the tale, he would warn us about the “flaw of averages,” which simply states that plans based on assumptions about average conditions usually go wrong.

If you’re preparing retirement planning material for an audience ranging in age from 50 to 80 years old, consider how useful it might be to tell them that “on average, you all have a 10- year life expectancy.”

Consider the chances of your members living beyond particular ages and how they might feel about that when setting retirement planning horizons. The Optimum Pensions Lifespan Calculator is a good place to start.

###

[i] The Treasury 2000. Retirement Income Review – Final Report, Canberra: Department of the Treasury, Commonwealth of Australia.[/vc_column_text][vc_column_text] ***

Optimum Pensions was launched in 2017 with a single mission – to help Australians lead a comfortable retirement. The Optimum Pensions innovative retirement income solutions are specifically developed to address longevity risk and provide greater peace of mind for all retirees; no matter how long they live.

The Optimum Pensions, award-winning LifeSpan Calculator builds confidence around personal life expectancy and retirees’ possible retirement planning horizon.